Did you ever read some credit repair company reviews online and feel hopeful? Imagine you're struggling with your credit and desperately need help. You search online and find a review that seems amazing. It talks about how this company turned someone's credit around super fast. You start thinking, "Could this be the answer to my problems?" But wait! Before you get too excited, take a step back. Not all reviews are trustworthy!

If you're dealing with serious credit problems, a credit repair company might be able to help. These companies specialize in finding and fixing mistakes on your credit reports to make your credit history better. And why does that matter? Well, a better credit score means you could get better deals on loans and save money, especially on big purchases.

But what if your credit score isn't exactly where you want it to be? Legitimate credit repair companies like ASAP Credit Repair USA can be the answer.

_________________________________________________

Why Credit Repair Company Reviews Matter

Before we go into the topic of how to evaluate reviews, let's first talk about why they're important.

Credit repair is a big decision that can affect your finances for years to come. Reading reviews from real customers can give you valuable insights into the quality of service provided by different companies. This can help you avoid scams and choose a company that's right for you.

Credit repair company reviews matter for several reasons, and there's data to back it up. Let me help you guys understand more why they’re crucial:

Avoiding Scams: According to the Federal Trade Commission (FTC), credit repair scams are prevalent. Reviews can help consumers steer clear of fraudulent companies promising quick fixes that never materialize. In 2020 alone, the FTC received over 281,000 reports of credit repair scams, resulting in losses exceeding $200 million.

Making Informed Decisions: Reviews provide insights into the experiences of previous customers, helping individuals make informed decisions. Studies show that 93% of consumers read online reviews before making a purchase decision, indicating the importance of reviews in guiding consumer choices.

Evaluating Effectiveness: Factual data and testimonials in reviews can help assess the effectiveness of credit repair companies. For instance, a study by the Consumer Financial Protection Bureau found that, on average, consumers who used credit repair services saw a 11point increase in their credit scores after six months.

Understanding Customer Satisfaction: Reviews reflect customer satisfaction levels, which are vital indicators of a company's performance. Research suggests that 84% of people trust online reviews as much as personal recommendations, highlighting the influence of reviews on consumer trust.

Identifying Credible Companies: Reliable reviews can point consumers towards reputable credit repair companies, ensuring they receive legitimate services. According to a survey by BrightLocal, 82% of consumers seek out businesses with positive reviews.

By leveraging factual data and statistics, consumers can navigate the credit repair industry with confidence and protect themselves from fraudulent practices.

_________________________________________________

Beware: The Rise of Credit Repair Scams

With the rise of the digital age, promises of quick fixes and instant solutions are everywhere.

It's essential to read carefully, especially when it comes to repairing your credit. Unfortunately, alongside legitimate credit repair services, there's been a surge in credit repair scams preying on vulnerable consumers.

So how can we spot those scams and protect ourselves?

Understanding the Threat

Credit repair scams come in various forms, but their goal is always the same: to exploit individuals desperate for a better credit score. These scams often promise unrealistic results, such as guaranteeing to remove negative information from your credit report overnight or significantly boosting your credit score in a short period of time.

The Numbers Don't Lie

The Federal Trade Commission (FTC) receives hundreds of thousands of reports each year related to credit repair scams. In 2020 alone, there were over 281,000 reports, resulting in staggering financial losses exceeding $200 million. These numbers underscore the widespread nature of the problem and the financial devastation it can cause for unsuspecting consumers.

Spotting the Red Flags

While credit repair scams can be sophisticated, there are common red flags to watch out for:

Guarantees of Immediate Results: Legitimate credit repair takes time and effort, so be wary of companies promising instant fixes.

Lack of Transparency: Reputable credit repair companies are transparent about their services, fees, and the process involved. If a company is vague or evasive when answering your questions, proceed with caution.

Protecting Yourself

Fortunately, there are steps you can take to protect yourself from falling victim to credit repair scams. Start by doing your research and thoroughly vetting any company before engaging their services. If you are eyeing for a specific company, make sure to do your thorough research.

Check their reputation with consumer protection agencies like the FTC and read reviews from community forums. You can start off by searching “credit repair companies reddit” thread to gauge their credibility.

Additionally, be wary of any company that:

Refuses to provide written information about your rights under federal law

Advises you to dispute accurate information on your credit report

Asks you to provide false information on credit applications

By staying informed and vigilant, you can safeguard yourself against falling victim to credit repair scams and take steps towards genuine credit improvement. Remember, if something sounds too good to be true, it probably is all lies.

In the next section, time to dissect those reviews. “Can I believe all of them?”. Stay tuned for practical tips on how to identify reliable reviews and make informed decisions about repairing your credit.

_________________________________________________

What to Look for in Credit Repair Company Reviews

Did you know that most aggressive credit repair companies or big companies pay established sites to sponsor, advertise or recommend them.

Why Reviews Aren't Always What They Seem

Sure, sites like Trustpilot and the Better Business Bureau seem reliable, but big companies often pay to shine there. It's like a fancy makeover hiding the real deal. Glowing reviews might not tell the whole story, especially when big bucks are involved.

Ever tried searching something in google, then end up finding only 12 companies always mentioned? While these endorsements can boost visibility and credibility, it's essential for consumers to recognize that they represent a financial relationship between the company and the site.

When reading reviews, keep an eye out for the following:

Credible Sources: Look for reviews from reputable sources like independent review websites or consumer advocacy groups. Avoid relying solely on testimonials posted on the company's website, as these may be biased.

Results: Pay attention to reviews that mention concrete results, such as improvements in credit score or successful removal of negative items from credit reports. While every case is different, positive outcomes are a good indicator of a company's effectiveness.

Transparency: Legitimate credit repair companies should be transparent about their fees, services, and process. Reviews that mention clear communication and upfront pricing are a good sign.

Customer Service: Good customer service is essential when dealing with credit repair. Look for reviews that praise the company's responsiveness, helpfulness, and professionalism.

_________________________________________________

Should You Believe All Negative Reviews?

Let's talk about negative reviews for credit repair companies. While it's tempting to believe every bad review you read, it's important to be smart about it. Here's why:

Competition Trouble: Sometimes, other companies leave bad reviews to make their rivals look bad. These reviews often sound overly mean and don't give much detail.

Lack of Patience: Fixing your credit takes time. Some negative reviews are from people who wanted instant results and got frustrated when it didn't happen. But good things come to those who wait!

Follow the Plan: Credit repair companies give advice on how to improve your credit. If someone leaves a bad review but didn't follow the advice, it's not really fair to blame the company.

So, next time you see a bad review, think twice. Is it from a real customer with a genuine problem, or is there more going on? Keep these things in mind, and you'll be better at sorting through the good and bad reviews.

_________________________________________________

How To Spot The Best Credit Repair Company Reviews You Can Trust

When you're thinking about buying something from a company, you want to know what other people think, right? Reviews are like little stories that tell you about the good and bad stuff people experienced when dealing with a business. And let's be honest, hearing about other people's experiences helps you decide if you want to give that company your business.

So, those reviews? They matter a lot to you and everyone else thinking about buying from that company. When it comes to finding reliable reviews, there are a few key factors to keep in mind:

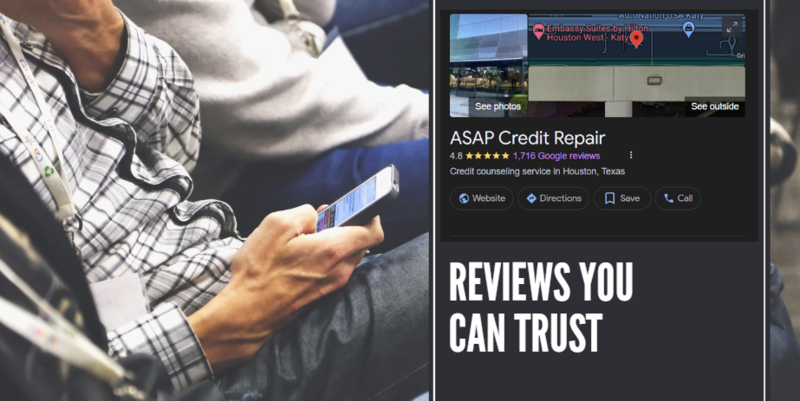

1. Volume Speaks Volumes: One of the first things to look for is the volume of reviews. Generally, the more reviews, the better. Google and other review platforms are getting better at flagging fake reviews, so if a business has thousands of reviews, chances are they're legitimate.

2. The Goldilocks Ratio: Take a look at the ratio of positive to negative reviews. A business with a rating of 4.5 stars or above is generally considered trustworthy. However, be wary of businesses with a perfect 5star rating, as this could be a sign of manipulated reviews.

3. Consistency is Key: Pay attention to the consistency of reviews over time. A business that consistently receives positive reviews is more likely to deliver a reliable experience. On the other hand, if you notice a sudden influx of negative reviews or a pattern of complaints, it's worth digging deeper before making a decision.

4. Context Matters: Consider the context of the reviews. Are they specific and detailed, or do they seem generic and vague? Reviews that provide specific examples of experiences, both positive and negative, are more likely to be genuine.

5. Look Beyond the Stars: While star ratings are a helpful starting point, don't rely on them alone. Take the time to read the content of reviews and consider the overall sentiment expressed by customers. A business with a few negative reviews but a thoughtful response and resolution process may still be worth considering.

By considering these factors and looking beyond the surface, you can find reliable reviews that provide valuable insights into the businesses you're considering. Remember, trust your instincts and approach reviews with a critical eye to make informed decisions.

_________________________________________________

Where to Find Reliable Reviews

So, where can you find trustworthy reviews? Here are a few options:

When it comes to finding reliable reviews, Google is your goto buddy. They've really stepped up their game in filtering out the fake stuff and making sure you get the real deal. So, whether you're searching for a restaurant, a plumber, or a credit repair company, you might as well go to google first.

Independent Review Websites

Sites like Trustpilot, Yelp and BBB compile reviews from real customers and assign ratings to credit repair companies based on their performance.

Disclaimer: While independent review websites like Trustpilot, Yelp, and BBB can be helpful resources for gathering information, it's essential to approach them with caution. While they aim to compile reviews from real customers and provide ratings based on performance, not all reviews may be genuine, and ratings alone don't necessarily define the entirety of a company's reputation. It's wise to consider a variety of factors and sources when evaluating a credit repair company, rather than relying solely on the ratings from these platforms.

Financial Forums

Forums like Reddit and quora can be a valuable resource for honest opinions and recommendations from real users.

Word of Mouth

Don't underestimate the power of personal recommendations. Ask friends, family, or colleagues if they've used a credit repair company and what their experience was like.

_________________________________________________

Conclusion: Making Informed Decisions

In conclusion, finding a reliable credit repair company can be a daunting task, but it's worth taking the time to do your research. By reading reviews from real customers and considering factors like credibility, results, transparency, and customer service, you can make an informed decision that's right for you. Remember, your financial future is at stake, so it's essential to choose a company you can trust.

With the right credit repair company by your side, you can take the first step towards improving your credit and securing a brighter financial future.

Sources:

Federal Trade Commission: Consumer Information on Credit Repair

Better Business Bureau: Tips for Choosing a Credit Repair Company

Consumer Financial Protection Bureau: Credit Repair Scams and How to Avoid Them

_________________________________________________

Finding Trustworthy Credit Repair Company Reviews Made Simple

In the hunt for a credit repair company, sorting through reviews can feel like stepping through a minefield. But fear not! We've got the lowdown on what to look for in reviews and why you can count on ASAP Credit Repair to deliver.

ASAP Credit Repair stands out because we keep it real: Our reviews speak for themselves – our customers love us because we're upfront about everything, from what we do to how much it costs

You Come First: Unlike some other companies, we're all about you. Your needs, your goals – they're our top priority. We'll work tirelessly to get you where you want to be, no matter how long it takes.

No False Promises: We're not here to sugarcoat things. Credit repair takes time, and we'll tell you exactly what to expect from the getgo. No surprises, no disappointments – just real results.

So, if you're tired of sifting through endless reviews, stop right here. ASAP Credit Repair is the real deal, and we're ready to help you take control of your credit – once and for all.