After fifteen years of helping clients navigate credit repair and optimization, I've witnessed countless cases where responsible borrowers see their scores plummet overnight due to utilization miscalculations. The most devastating part? These aren't reckless spenders or people missing payments. These are individuals who understand credit fundamentals but fall victim to the complex, often counterintuitive mechanics of how utilization actually impacts credit scores.

The relationship between credit utilization and scoring algorithms involves intricate timing mechanisms, individual versus aggregate calculations, and reporting inconsistencies that can transform routine financial decisions into credit disasters. Understanding these mechanisms requires examining both the mathematical foundations of utilization scoring and the practical scenarios where responsible credit management strategies backfire.

What is Credit Utilization?

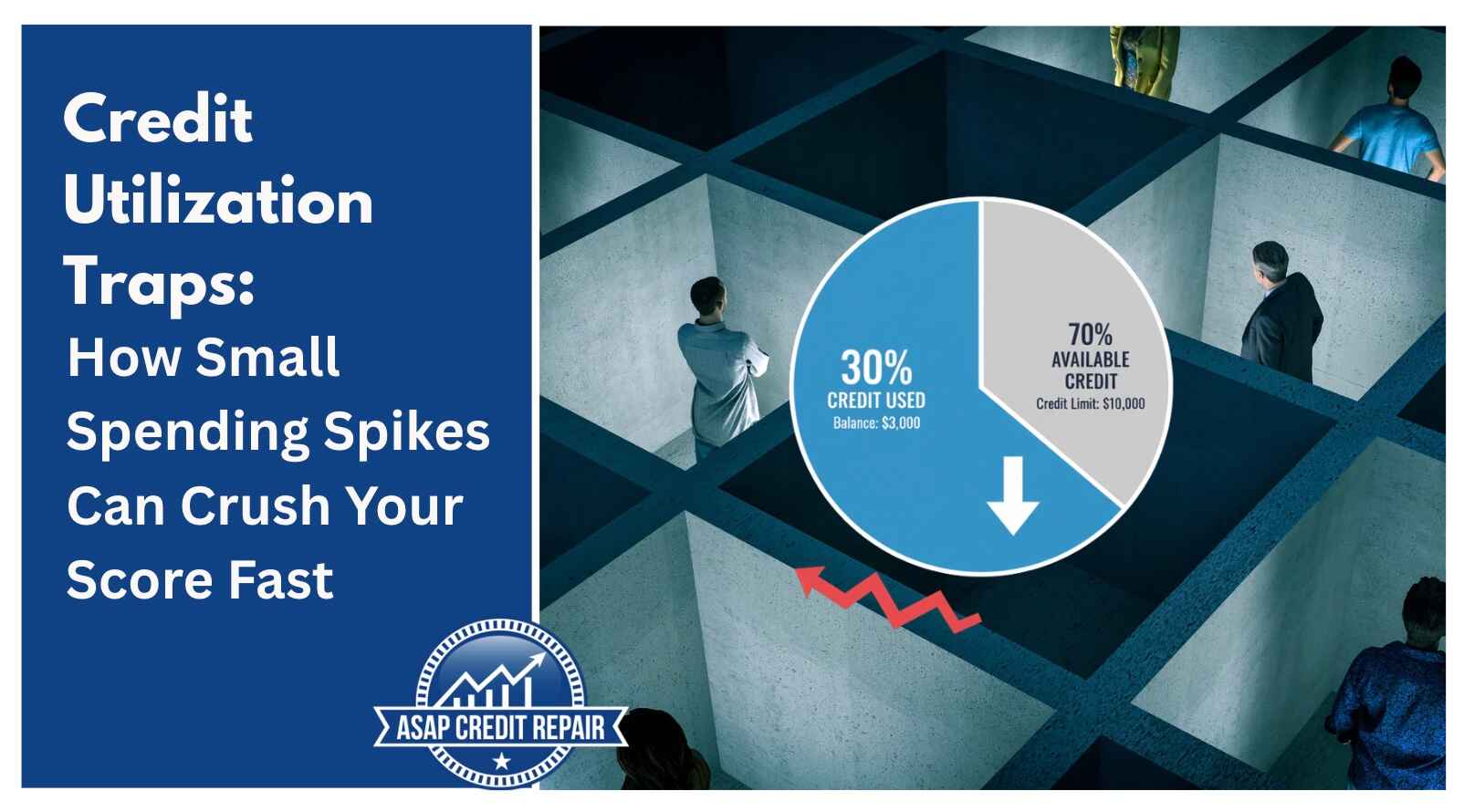

Credit utilization is the percentage of your available credit that you’re currently using.

It’s calculated by dividing your credit card balance by your total credit limit, then multiplying by 100.

Example: If you have a $1,000 limit and a $300 balance, your credit utilization is 30%.

Credit utilization makes up about 30% of your FICO credit score, so it’s the second most important factor after payment history.

The lower your utilization, the better. Experts recommend keeping it below 30%, but the best scores often come from staying under 10%.

In short, credit utilization shows lenders how much of your available credit you’re using. Keeping it low signals that you manage credit responsibly.

The Mathematical Reality Behind Credit Utilization Scoring

Credit utilization represents 30% of your FICO score calculation, making it the second-most influential factor after payment history. However, the algorithmic approach to utilization assessment differs significantly from common consumer understanding of "keeping balances low."

The Graduated Impact Model Beyond 30%

While financial education frequently promotes the 30% utilization threshold as a safe target, credit scoring models implement graduated penalties that begin affecting scores at much lower utilization levels. Research data from FICO indicates that consumers with scores above 800 maintain average utilization rates of 4.1%, while those in the 700-750 range typically utilize approximately 7-10% of available credit.

The scoring algorithm applies incremental penalties as utilization increases: 10-20% utilization begins reducing scores modestly, 20-30% creates more significant impact, and anything exceeding 30% triggers substantial point reductions. Utilization above 90% on any individual account can reduce scores by 60-100 points, regardless of overall portfolio utilization.

This graduated model explains why consumers often experience unexpected score drops when their utilization crosses these invisible thresholds, particularly during months with higher-than-normal spending patterns.

Dual-Layer Utilization Assessment: Individual and Aggregate

Credit scoring algorithms evaluate utilization through two distinct calculations: individual account utilization and aggregate portfolio utilization. Both assessments influence your score independently, creating scenarios where excellent aggregate utilization cannot compensate for problematic individual account ratios.

Individual account utilization exceeding 50% triggers significant scoring penalties even when total portfolio utilization remains optimal. This mechanism particularly affects consumers who concentrate spending on specific cards for rewards optimization or convenience, inadvertently creating high individual utilization despite maintaining low overall ratios.

The dual assessment also explains why distributing balances across multiple accounts often produces better scores than concentrating equivalent debt on a single high-limit card, even when total utilization percentages remain identical.

Statement Date Versus Payment Date Reporting

Credit card issuers report account information to bureaus based on statement closing dates, not payment due dates. This timing mechanism creates a fundamental disconnect between consumer payment behavior and reported utilization levels.

A purchase made three days before statement closing will report at full balance regardless of payment timing. Conversely, payments processed after statement closing affect subsequent month reporting, not the current cycle. This timing lag means responsible payment behavior doesn't prevent temporary utilization spikes from impacting credit scores.

Different issuers employ varying reporting schedules, with some updating bureaus multiple times monthly while others report only during specific billing cycle points. This inconsistency makes predicting utilization impact challenging without detailed knowledge of individual issuer practices.

High-Impact Utilization Scenarios in Practice

I want to share a real story with you about something a client experienced that perfectly illustrates how utilization traps catch responsible borrowers off guard. This client, a marketing director with excellent credit management habits, had maintained a 740 score for over two years through careful monitoring and timely payments. She decided to renovate her kitchen and, being financially responsible, budgeted the entire $12,000 project.

Rather than taking a personal loan, she chose to put expenses on her primary rewards card (which had a $15,000 limit) to earn cash back, planning to pay the balance immediately after receiving her annual bonus. The renovation costs hit her card over a three-week period: $4,500 for cabinets, $3,200 for appliances, $2,800 for labor, and $1,500 for miscellaneous materials.

Her statement closed two days after the final payment to contractors, showing a $12,000 balance on a $15,000 limit—80% utilization on that individual card. Despite having $45,000 in unused credit across other cards, her score dropped from 740 to 650 within one reporting cycle. Even though she paid the full balance immediately after receiving the statement, the damage persisted for two additional months while the lower score propagated across different bureau reporting cycles.

This case demonstrates how project-based spending, even when carefully planned and promptly paid, can create devastating temporary utilization spikes that take months to resolve.

Travel and Business Expense Concentration Effects

Business travelers and individuals who concentrate travel expenses on specific cards face recurring utilization challenges due to the lumpy nature of travel spending. Hotel prepayments, flight bookings, and rental car holds create temporary balance spikes that often coincide with statement closing periods.

Corporate reimbursement delays compound these issues, particularly when expense processing takes 30-60 days. During this period, legitimate business expenses create sustained high utilization that persists across multiple reporting cycles, damaging personal credit scores for professional spending decisions.

Premium travel cards often carry lower credit limits relative to their target demographic's spending patterns, exacerbating utilization problems. A $25,000 annual travel budget concentrated on a card with a $30,000 limit creates sustained utilization issues that rewards optimization strategies don't address.

Emergency Expense Cascade Effects

Medical emergencies, major vehicle repairs, or unexpected home maintenance create concentrated spending that bypasses normal utilization management strategies. These expenses typically require immediate payment, often occurring regardless of statement timing or existing card balances.

The psychological stress accompanying emergencies prevents careful credit management, leading consumers to use whatever credit is most convenient rather than optimizing utilization across available accounts. A $6,000 emergency medical procedure charged to a card with an $8,000 limit creates 75% utilization that persists until insurance reimbursements or payment plans resolve the balance.

Multiple simultaneous emergencies compound utilization problems exponentially. Emergency veterinary care, urgent home repairs, and unexpected travel for family emergencies occurring within the same billing cycle can push multiple cards into dangerous utilization territory simultaneously.

Statement Timing and Reporting Complexity

Understanding statement timing requires recognizing that credit card companies operate on individualized billing cycles that rarely align with calendar months or consumer financial planning periods. Each account maintains its own closing date, creating a complex matrix of reporting periods across a typical consumer's credit portfolio.

Multi-Card Timing Coordination Challenges

Consumers maintaining multiple credit cards face coordination challenges when managing utilization across different statement closing schedules. A portfolio containing cards closing on the 3rd, 15th, 22nd, and 28th of each month requires tracking spending patterns across four distinct reporting windows.

Large purchases made without consideration of multiple closing dates can create unpredictable utilization reporting. A significant expense charged to the wrong card relative to its closing date can report high utilization for an entire month, while the same purchase on a different card might report minimal impact.

Balance transfers between cards with different closing dates create temporary double-reporting scenarios where both the source and destination accounts show balances until reporting cycles align. This phenomenon can artificially inflate total reported utilization for 30-60 days following transfer completion.

Weekend and Holiday Reporting Delays

Credit bureaus and card issuers suspend reporting activities during weekends and federal holidays, creating unpredictable delays between account activity and credit report updates. These delays particularly affect consumers attempting to optimize utilization through strategic payment timing around statement closing periods.

A payment made on Friday before a three-day weekend may not process until the following Tuesday, potentially missing a Monday statement closing date. Similarly, large purchases made during holiday periods may report for extended periods before corresponding payments update bureau records.

These processing delays explain why consumers often see unexpected utilization reporting despite careful timing of payments and purchases around known statement dates.

Individual Account Versus Portfolio-Level Management

The dual-layer utilization assessment creates scenarios where portfolio-level optimization fails to prevent score damage from individual account problems. This complexity requires sophisticated management strategies that go beyond simple "keep balances low" approaches.

High-Limit Card Concentration Risks

Consumers often assume that concentrating spending on high-limit cards provides utilization protection. However, individual account utilization penalties apply regardless of the account's credit limit relative to other accounts in the portfolio.

A $5,000 balance on a $50,000 limit card represents only 10% utilization, which seems safe. However, if this represents the only active balance in an otherwise zero-balance portfolio, the scoring algorithm may penalize the concentration of all utilization on a single account, particularly if that account has a shorter credit history or different issuer risk characteristics.

Conversely, distributing the same $5,000 across five cards with $10,000 limits each creates 10% utilization across multiple accounts, which typically produces better scoring outcomes than concentrating the balance on a single high-limit card.

Store Card and Specialty Account Impacts

Retail store cards and specialty financing accounts often carry significantly lower credit limits than traditional bank credit cards, making them particularly susceptible to high individual utilization ratios. A $800 purchase at a department store using their branded card with a $1,000 limit creates 80% utilization that severely impacts scoring.

These specialty accounts report to credit bureaus using the same utilization assessment algorithms as major bank cards, meaning high utilization on a store card affects scoring identically to high utilization on a premium rewards card. The account type or issuer doesn't influence the utilization penalty calculation.

Many consumers use store cards infrequently, making it easy to forget their low limits when making larger purchases. An annual clothing shopping trip or home improvement project can inadvertently max out these accounts, creating sustained utilization problems that persist until manually addressed.

Credit Limit Management and Bank Risk Assessment

Credit card issuers regularly reassess account risk and adjust credit limits based on internal risk models, economic conditions, and regulatory requirements. These adjustments can instantly transform manageable utilization into score-damaging ratios without any change in consumer spending behavior.

Automated Limit Reductions and Their Triggers

Banks employ automated systems that monitor account usage patterns, credit report changes, and macroeconomic indicators to identify accounts for limit reductions. These systems may reduce limits based on decreased usage, changes in credit profile, or shifts in bank risk appetite that have nothing to do with individual account management.

I want to share another real situation that happened with a client that demonstrates how limit reductions can devastate even excellent credit management. This client, a small business owner, had maintained a business credit card with a $25,000 limit for over five years, typically carrying a $3,000-5,000 balance (12-20% utilization) that he paid in full monthly. His personal credit score consistently stayed above 720.

During the economic uncertainty of early 2020, his bank reviewed accounts and determined that small business cards represented elevated risk. Without advance notice, they reduced his limit from $25,000 to $8,000. His existing $4,500 balance instantly became 56% utilization instead of 18%. His personal credit score, which had been 728, dropped to 665 within one month because this business card reported to personal credit bureaus.

The reduction happened despite perfect payment history, stable business income, and no changes in his personal financial situation. It took four months of maintaining zero balances and multiple limit increase requests to restore his previous credit standing, during which time he was denied for a mortgage refinance that would have saved him $300 monthly.

This case illustrates how external factors beyond consumer control can instantly transform well-managed credit into scoring disasters, requiring immediate remedial action to prevent extended credit damage.

Inactivity-Based Credit Management

Card issuers interpret account inactivity as reduced credit need and may reduce limits on unused accounts. This practice particularly affects consumers who maintain multiple cards for utilization management purposes, keeping most accounts inactive to maintain low utilization.

The optimal utilization strategy of maintaining most cards at zero balances conflicts with issuer preferences for account activity. Banks want to see regular usage that generates interchange revenue, while credit scoring benefits from minimal utilization across multiple accounts.

Balancing these competing interests requires strategic minimal activity across all accounts while maintaining overall low utilization. This typically involves small recurring charges ($5-15 monthly) on otherwise inactive cards, paid in full automatically to maintain activity without creating significant utilization.

Advanced Recovery and Prevention Strategies

Effective utilization management requires systematic approaches that account for timing complexities, multiple account coordination, and risk mitigation against external factors like limit reductions or emergency spending needs.

Pre-Statement Payment Protocols

Implementing payment schedules based on statement closing dates rather than due dates provides control over reported utilization regardless of spending patterns during billing cycles. This approach requires maintaining detailed calendars of closing dates across all accounts and establishing payment routines that ensure low balances report consistently.

Optimal implementation involves making payments 2-3 business days before statement closing to account for processing delays and weekend interruptions. For large purchases, immediate payment after transaction posting prevents high balances from persisting until statement closing.

Some consumers implement mid-cycle payment protocols, making two payments monthly on each account: one at mid-cycle to reduce running balances and another before statement closing to optimize reported utilization. This approach provides maximum protection against utilization spikes while maintaining normal spending flexibility.

Strategic Account Portfolio Design

Sophisticated utilization management involves designing account portfolios specifically for utilization optimization rather than focusing solely on rewards, benefits, or interest rates. This strategy prioritizes credit limits, reporting patterns, and closing date distribution across the portfolio.

Optimal portfolio design includes maintaining at least one account with significantly higher limits than typical monthly spending, providing buffer capacity for emergency expenses or unusual spending periods. Additionally, distributing account closing dates across the month prevents concentrated utilization reporting during specific periods.

Account selection should consider issuer reporting practices, with preference for banks that offer reporting date flexibility or multiple reporting cycles monthly. Some issuers allow customers to request specific closing dates, enabling optimization of reporting timing across the entire portfolio.

Technology-Assisted Monitoring Systems

Modern utilization management benefits from automated monitoring systems that track balances, utilization ratios, and approaching closing dates across multiple accounts. These systems can provide early warning alerts when utilization approaches problematic thresholds, enabling proactive management before scoring damage occurs.

Effective monitoring includes daily balance updates, utilization ratio calculations for individual accounts and portfolio totals, and calendar integration for statement closing dates. Advanced systems can simulate the impact of planned purchases across different accounts, helping optimize spending allocation for minimal utilization impact.

Some credit monitoring services provide utilization trend analysis, helping identify patterns that might indicate developing problems. These tools can highlight increasing baseline utilization, concentration risks, or accounts approaching problematic thresholds before they impact credit scores.

Professional Perspective on Long-Term Credit Health

Based on extensive experience helping clients optimize credit profiles, successful utilization management requires understanding that credit scores represent a complex algorithmic assessment that often conflicts with intuitive financial management approaches. The most financially responsible decisions don't always produce optimal credit scoring outcomes.

Effective long-term credit management involves balancing utilization optimization with practical financial needs, rewards maximization, and overall portfolio efficiency. This balance requires accepting that perfect credit optimization may not always align with perfect financial optimization.

The key insight for consumers is recognizing utilization management as an ongoing process requiring active attention rather than a set-and-forget strategy. Credit card terms, bank policies, and personal financial situations change regularly, requiring corresponding adjustments to utilization management approaches.

Most importantly, understanding utilization complexity helps consumers make informed decisions about when to prioritize credit score optimization versus other financial objectives. Sometimes accepting temporary score impact to handle legitimate financial needs represents the optimal long-term strategy, particularly when combined with systematic recovery protocols.